The Cycle

I have been thinking a lot about economic cycles lately with the surge in speculative activity during the first quarter of 2014 and Facebook’s recent $19 billion takeover of WhatsApp. This is the 4th largest technology acquisition in history and there have been a record breaking $42.4 billion worth of mergers and acquisitions in the first month and a half of 2014 according to Thomson Reuters.

VIX (The “Fear Index”)

It is clear that fear, which overcomes financial markets every 5-10 years, is on the back-burner at the moment. With Y Combinator founded in 2005, TechStars in 2006, outspoken venture capitalists blogging daily and tweeting about the hottest trends in tech, it seems as if people have forgotten or don’t care to remember about past failures.

“Yeah, boy, we really screwed up a bunch of things.” – Fred Wilson, Union Square Ventures

The biggest red flag that I see right now is the use of alternative valuation metrics. Just like “clicks” and “eyeballs” during the dot-com bubble, everyone seems to have their own way of justifying sky high prices. $40 per active user, 450 million average daily users, $345 million per employee, etc.

Hackers & Painters

My favorite Paul Graham essay is contained in a book that I happened upon in the Courant Library called “Hackers & Painters”, but one of his more recent writings “Startup = Growth” has me intrigued. He makes the distinction between a business and a startup, claiming that the defining feature of a startup is growth.

“But I also mean startups are different by nature, in the same way a redwood seedling has a different destiny from a bean sprout.” – Paul Graham, Y Combinator

But I don’t see anything about growth in the following definition:

“Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during its remaining life.” – Warren E. Buffett, Berkshire Hathaway

The best way to differentiate between bean sprouts and redwoods is intrinsic value. There is no telling when the “animal spirits” will subside, and I wouldn’t be surprised to see the market soar up to new highs, but in the end stock prices will reflect the value of the underlying businesses.

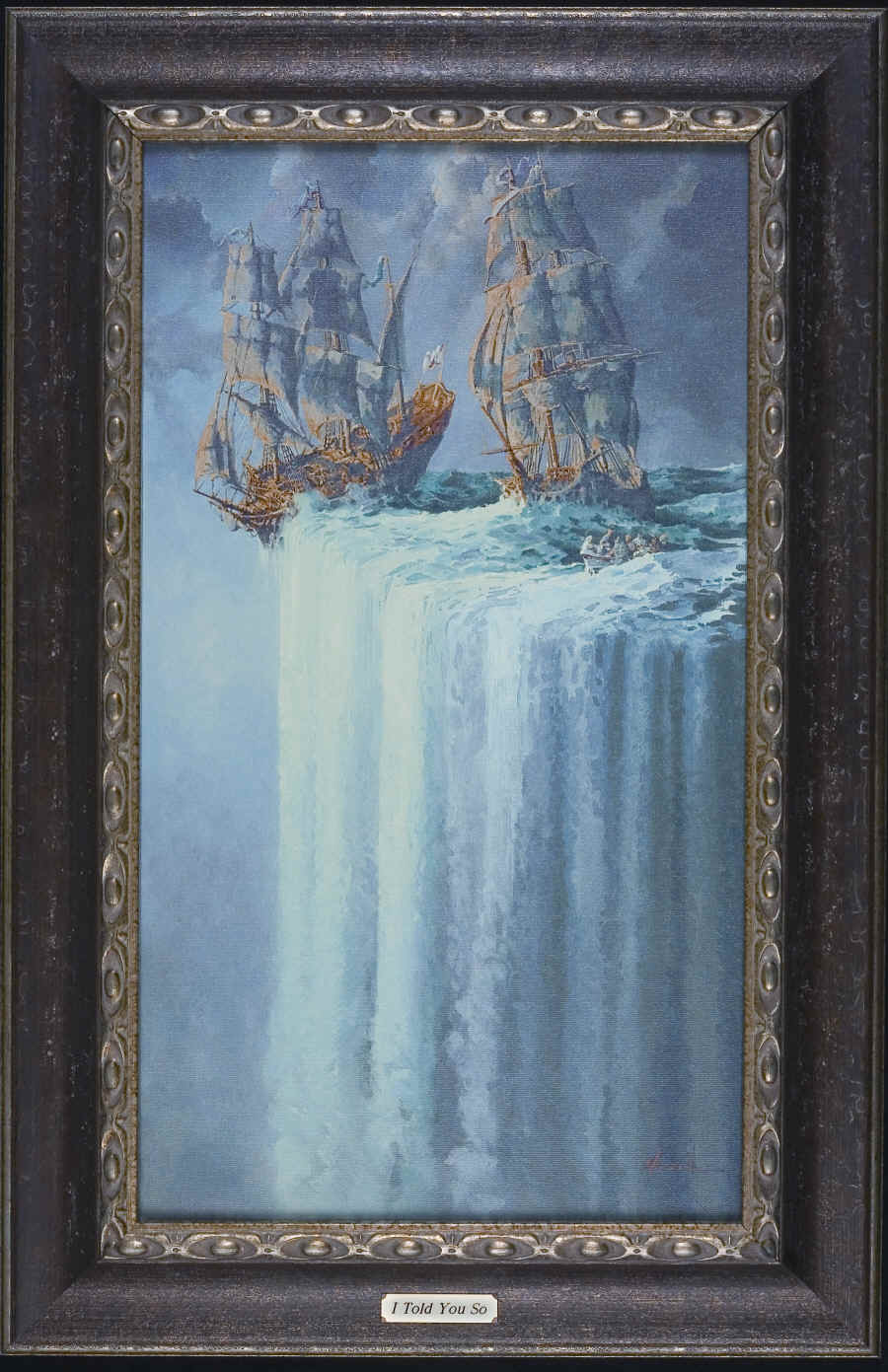

I Told You So

“In the short term, the stock market behaves like a voting machine, but in the long term it acts like a weighing machine.” -Benjamin Graham